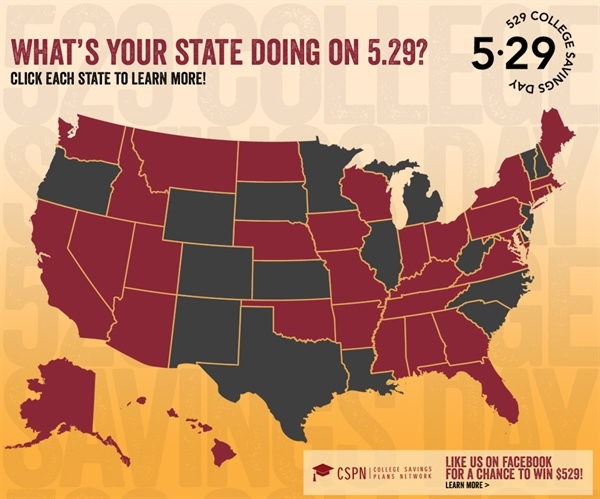

College Savings Month on September, 2024: College - Loans & Savings?

September, 2024 is College Savings Month 2024. 529 - Saving for College Start To Save The Smart Way Today Find the Right 529 Plan For You Now

As an Amazon Associate I earn from qualifying purchases.

Increase your savings to at least 10%. In Japan, they save 25% if you can believe it! They once did too in the good ol US of A. I like how you got your relatives to back you up like that. The Corolla was a good choice, but a bad idea to buy it new. Your payments are very high for some reason. See what you can do to refinance the car after you have made at least one year in payments. I should say, after your Mom pays.

You are doing VERY WELL with the exception of your outrageous car payment. In my opinion, for someone in your position, you should have no higher than a $199/mo payment.

Good grades will lower your auto insurance payments. Ask your insurance company.

My other suggestion is to forget paying off your student loans and put more money away in something simple like an online savings account or high interest CD. Your loans are so small I can deduce they are federal. Interest rates are so low and in deferment while you are in school. Consolidate through the Department of Education, only and you will be able to lock in a rate that is lower than what most online savings accounts and high interest CDs offer.

Again, good job. I hope that one day I have a daughter that tries like you.

Best college savings plan?

If you are saving for college expenses, you should take advantage of federal tax breaks aimed at families saving and paying for college. These include the following:

Qualified Tuition Programs (529 plans)—Earnings grow tax-deferred and distributions are tax-free when used for qualified post-secondary education costs.

Coverdell Education Savings Accounts— Earnings grow tax-deferred and distributions are tax-free when used for qualified post-secondary education costs. May also be withdrawn tax-free for primary and secondary school expenses.

However, don't invest more in these than you chlld will need for college. There are tax penalties for non-educational withdrawals. Additional funds should be invested in a UGMA or UTMA.

For more information read this link, where most of this information comes from:

I may also add that you should also be putting the maximum away for your own retirement now in 401k's and IRA's, before saving money for your child. If you max out your retirement investments now, you can put in less later on, and have more money to donate to your child then. Also if it turns out your child is not college material, you won't have to pay the withdrawal penalties from a 529. Your child can always borrow money to fund her college, you can't borrow money to fund your retirement. Get your retirement squared away first; the last thing your child wants to do is have to support you in your old age, because you didn't plan ahead.

What is a bank savings account?

Savings account are simply a safe place to put aside money. Additionally, you're money gains interest (a certain percentage of the money you put in gets added to your account each month).

Parents usually use savings accounts for their children to set aside money for college when they're young.

The card to take money out of your account is called an ATM card. These are linked with checking accounts. In a checking account, you can write checks, deposit or withdraw cash from an ATM machine with your card, or you can spend the money using a debit card.