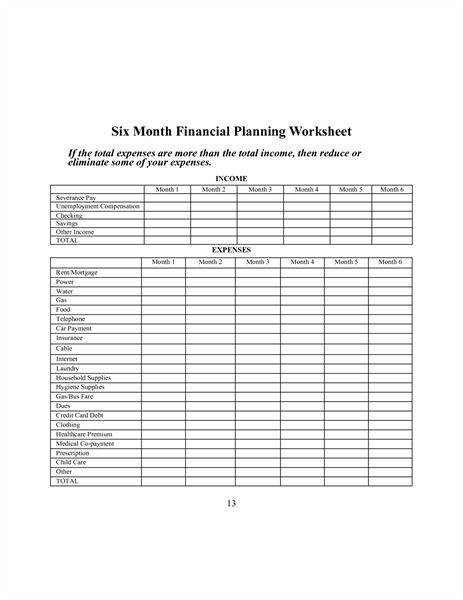

Financial Planning Month on October, 2024: financial planning?

October, 2024 is Financial Planning Month 2024. Ameriprise Financial — Our Approach To Financial Planning Starts With What Matters To You.

As an Amazon Associate I earn from qualifying purchases.

I agree with the comment about not needing insurance to cash in for the kids.

Some things to consider

1. Emergency fund of 3 - 6 months in case of job loss, unexpected expenses

2. Retirement savings - should be saving about 10 + % of the income for that.

3. If the interest on the student loan is high you may wish to pay that off.

4. Kids college education

A financial advisor - is that really a stock broker? or an insurance agent? If it is you may wish to also see a fee only financial planner. Stock brokers and insurance agents have a built in conflict of interest - they make money by selling you their company's products or other products that are high cost (to cover their commission).

A fee only financial planner only collects a fee that you know of up front. It isn't cheap but you get someone who can give you advice without that conflict. They will usually recommend lost cost index mutual funds (e.g. From Vanguard) with annual expenses of 1/4 of one percent vs most brokers or insurance agents that will sell you a fund with a some front on back end fees and an annual expense ratio of 1% or more.

Beware of advice to buy annuities, variable, universal or whole life insurance, mutual funds with front or back end loads (Class A or Class B shares) or with expense ratios of more than 1/2 of 1%.

For Insurance - you should look at guaranteed renewable term insurance - it is really cheap until you get older and then you really don't need it. For investments - a well diversified portfolio of index mutual funds e.g. Vanguard: Total Stock Market, Total International Stock Market, Total Bond Market,

or one of their Life Strategy or Target Retirement Funds. After meeting with the financial advisor I would suggest looking at the diehard.org site below. Lots of good advice and if you ask them a question or for a asset allocation they will do it. It is a group of mostly very wise and friendly investors that have a general investment philosophy. They also have a good reading list that you should consider.

Good Luck

financial planning help?

You make long term Financial Planning. The long term planning covers

Budget for your marriage

For a car ( as you prefer car )

A house / flat for you

For Children's Education

For their Marriage

For a happy retired life

There are so many areas of investment like

Investment in Shares - risk is more but earning is also better

A good insurance policy and medical insurance

Investment in Mutual Funds

Investment in Tax Free schemes

Investment in Gold

Investment in real estate

Investment in bank Deposit, Bonds etc.

You may write to magazines like ' Outlook Money ' you will get good guidelines

and read the articles published in the magazine, you will get good ideas.

Help with financial planning?

details about financial planning