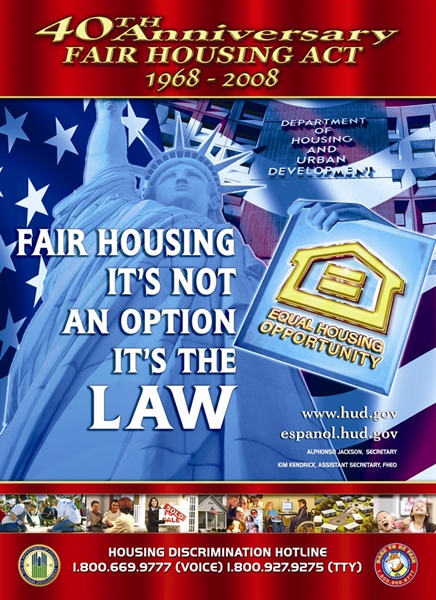

Fair Housing Month on April, 2024: Fair Housing for a disabled person.?

April, 2024 is Fair Housing Month 2024.

As an Amazon Associate I earn from qualifying purchases.

Monday, call your local HUD office and ask for confirmation that the information the landlord gave you was correct. Even if the information about the processing is correct, it may not be possible to evict you. Or most certainly give you more notice.

No one wants to be evicted, but an eviction takes 6 months. And you could use that 6 months to get a case for you to stay. Some housing is for adults only and their claim could be legitimate, but it is their error not yours and they must give you adequate time to move.

If you get no where with HUD, call your local university law schools and see if they would take up your cause.

Fair Housing Act? Potential lawsuit?

You can file a complaint on any one or any entity subject to the Fair Housing Act. In this case you should by pass the manager and contact your local Fair Housing Office directly or you may also contact the National office at HUD.GOV. I recommend using your local HUD office and simply explain the situation and they will advise you what action to take or what action they will take.

I assisted a couple some months back in which they contacted the local Dallas office. Within a couple of days the local Fair Housing Office had contacted the landlord and resolved their problem. They also have not had any problems since. I am sure your local Fair Housing Office will resolve your issue very quickly too.

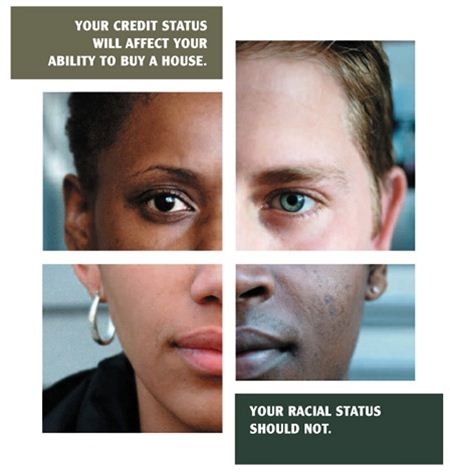

Will we be able to get a fair mortgage? What are our Options?

Option 1:

1) Start looking for houses but do not offer

2) Sell your house. for 70 K+

3) Move you stuff into storage and rent a furnished appt for one or two months.

4) Buy a house using the 45K as a down payment. By using a large down payment you will reduce your mortgage by a fair amount.

Option 2:

1) Try to sell your house conditional on you selling your houlse. This will usually get you less money but you won't need bridge funding. The downside is that if you don't sell you house in time, you will lose your down payment.

Bridge loans can get out of hand if you cannot sell your house in time. Best used either when you have already arranged both the purchase and the sell so it is for a set time limit not open-ended.